Most people prefer something enjoyable rather than worrying about investments. But we do want the security and financial benefits that come from solid investments. We at Mainstream Investments strive to make the whole process of investment safer and more fun without needing to think of it all the time as you head down life’s highway.

About us

We (Mainstream Investments Services Pvt. Ltd.) are a dedicated Wealth Management Company working in this area since 2005. In this span of time, Mainstream Investments Services Pvt. Ltd. has earned the trust and goodwill of its client and respect from the Investment community.

We are guided by a firm belief that every one of us is capable of attaining abundance by ethical means.

Our Focus

Financial Awakening

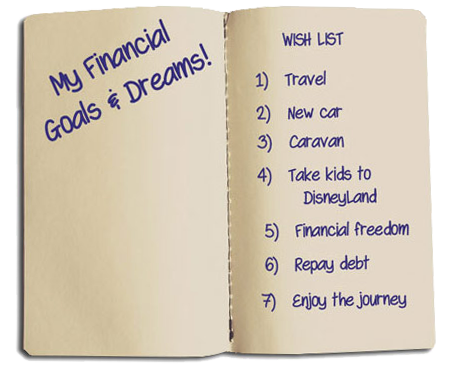

Many of the financial plans for prosperity fail to achieve the desired results because they focus only on money which is just a tiny aspect of prosperity. What we need is paradigm shift in the way we think about prosperity. The programme that we designed focuses not only on financial freedom but also develop a proper perspective so that we enjoy the most precious thing ‘Life” itself..

So lets start the plan that is going to transform your life

Read more in Our Focus tab

How we guide your dreams into reality

We at Mainstream Investments strive to make the whole process of investment safer and more fun without needing to think of it all the time as you head down life’s highway.

1

1We focus on Preparing a Financial Road Map

2

2We focus on Systematic Investment Plan

3

3We focus of Consistent Performing Funds

4

4Risk Appetite, determining how much investment risk you can handle

Investor’s Success Story

I met Mr Ramalingham in 2007 through a reference from an existing client. In our very first meeting, I noticed the following things --

- Mr Ramalingham was a reluctant investor; he had never invested in mutual funds and in fact, was not even aware of them.

- For him trust was everything. He left everything to my wisdom. He simply told me “give me the forms and I will sign wherever you tell me to”.

- He believed in long term relationships.

It was a big responsibility to understand the profile of Mr Ramalingham and then decide the investment avenues myself. I simply told him that I was designing a portfolio with at least a 10 year time horizon and that he should not touch this money before this period. He agreed to the proposal.

I made him start with a combination of lump sum and SIPs in equity funds. I still remember that once we got the application forms filled up, he took them to the temple and prayed for divine success. I told him that he was actually praying for the Indian Economy to grow well. Because if the economy did well, so would equity mutual funds.

The prayer was certainly answered in a magnificent manner. What started with an investment of Rs 3 lakhs and a SIP of 5000 per month, is now a portfolio that has crossed a value of Rs 50 lakhs.

Currently, he is investing Rs 20,000 per month. His retirement is 5 years away and the required corpus for this goal is Rs 3 crores. He has a flat in Noida with a current value of Rs 60 lakhs, and the value of his PF is Rs 40 lakhs which he has earmarked for his retirement goal. Thus the remaining amount of about Rs 1.5 crores needs to be attained from mutual funds. He is planning to invest Rs 50,000 per month from 1st April so that he would come closer to his desired retirement corpus.

We wish him all the very best for his success.